Why here, why now? presented by for Entrepreneur Quarterly

Active Pharmaceuticals Ingredients Innovation Center (APIIC) is Reshoring a Vital Industry and Restoring Health Security

Reading Time: 14 minutesAs part of EQ’s building a contextual map of the St. Louis innovation and entrepreneurial scene, we interviewed Anthony Sardella, the Chairman and CEO of the Active Pharmaceuticals Ingredients Innovation Center (hereafter referred to as the API Innovation Center), an independent business leveraging our region’s bioscience and manufacturing strengths to solve a vital twenty-first century challenge. We thank Tony and his staff for generously sharing with us their expertise, their enthusiasm for the API Innovation Center’s mission, and their assistance with this narrative. What follows stems from this interview and the API Innovation Center’s published reports.

Writing by Mike Fabrizi. Mike Fabrizi was born and raised in St. Louis, Missouri. An expat for 30 years to the Washington, DC area, he recently retired from a career including long stints with The MITRE Corporation, of McLean, Virginia, and The Aerospace Corporation, of El Segundo, California. Mike’s professional interests include complexity and complex adaptive systems, economic complexity, cities, and regenerative agriculture. He looks for ways to bridge the urban-rural divide, and likes to emphasize that which we share in common, not that which divides us. *Most* people everywhere are good. Give them half a chance and the goodness manifests itself. Mike now happily resides back home in St. Louis.

The Cortex Innovation District is one of the cauldrons from which the new St. Louis economy is emerging.

It houses several innovation centers, which operate as independent businesses, spanning biotechnology to cybersecurity to energy. One of these is the API Innovation Center, the purpose of which is to:

- Address the over-reliance on offshore manufacturing of critical generic medicines and their Active Pharmaceutical Ingredients, or APIs, which could put American health security at risk, especially during a crisis such as a future pandemic.

- Rebuild the American generic drug manufacturing industrial base, which will bring economic and labor force enhancement benefits, especially to Missouri and the St. Louis Metropolitan Statistical Area (MSA).

These benefits will be widely shared among labor force participants, including those without an extensive academic background. Rebuilding this industry will also enhance our nation’s health security.

Click to Open Table of Contents:

How We Got Here

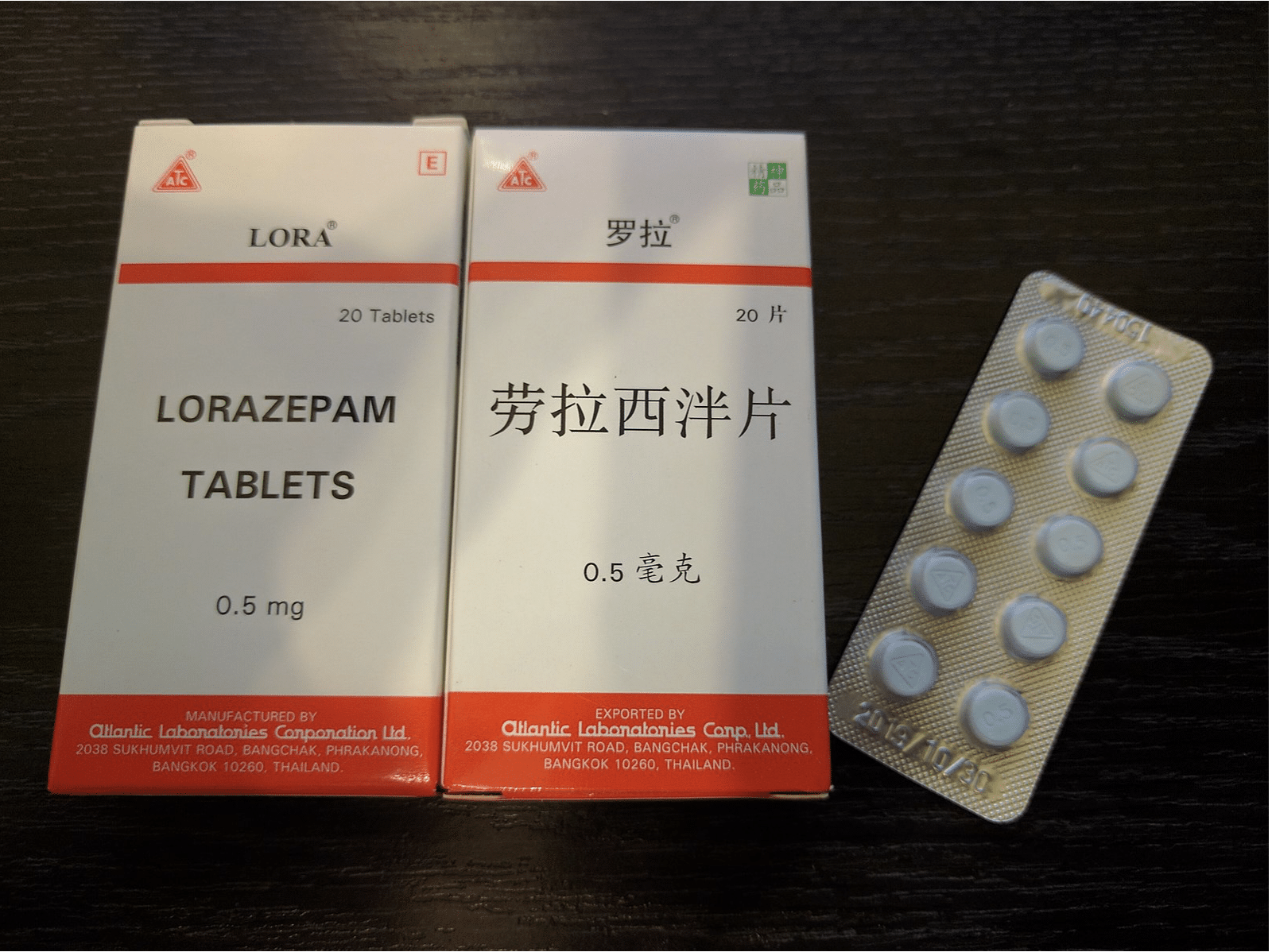

Generics comprise over 90 percent of American prescriptions. They are a key to keeping Americans healthy, and providing relief from various illnesses.

However, due to the generic market’s extreme price sensitivity, it has “raced to the bottom” in recent decades. Procurers, such as pharmacy chains, hospital systems, Government health-care providers, and others, place large orders solely on the basis of price, and do not tend to consider other factors, such as quality or country of origin.

Commoditization

It gets worse. Discussions with Tony Sardella, the API Innovation Center’s Chairman and CEO, indicate that, “…manufacturers are often asked to compete their whole product lines. Losing [such a competition] could leave a producer with much slack capacity [and wasted capital]…”

As a result, a “commoditization loop” has ensued, with 80 percent of API manufacture having migrated offshore, primarily to India and China. (An API is an ingredient which gives a medication its therapeutic effect. For example, an API might provide the pain relief for which the generic is administered. Other ingredients do things like make the drug more digestible, etc.)

Overseas producers have a cost advantage. Their labor costs are lower. In addition, they often benefit from foreign government subsidies and a lighter regulatory burden.

Thus, American consumers get their generic medicines inexpensively. The downside for us, though, is that the massive offshoring of these generics puts American health security at risk.

Tight Conditions

The generic drug industry financial statistics further evince distress. The bottom quartile of manufacturers report an Earnings Before Interest, Taxes, and Depreciation Allowance (EBITA) to revenue ratio of less than 15 percent, indicating razor-thin operating margins with most of revenue going to cost of goods sold. These enterprises also report a Return on Invested Capital (ROIC) of less than five percent, which barely keeps pace with recent inflation and is less than could be earned via passive, portfolio-type investments.

Closeout Rates

Yet another sign of distress is Food and Drug Administration (FDA) Warning Letters, which warn manufacturers that their quality or processes are deficient, are not being closed out.

For 2022, the most recent year for which data are available, the closeout rate was only four percent. This indicates that the producers consider deficiency resolution to be cost prohibitive, given prevailing business conditions.

Supply Disruptions

Generic medicine procurers, too, suffer under current arrangements. In addition to less transparency with respect to quality, supply disruptions are a factor.

A foreign government might compel its manufacturers to stop exporting critical medicines during a crisis, such as a future pandemic. This occurred for some medical supplies during COVID-19.

Also, geopolitical tensions cannot be ruled out as disrupting supply, with a foreign government possibly threatening to withhold shipment of critical generics as leverage during a conflict. Finally and more prosaically, a foreign manufacturer might be acquired by another company, which might then exit the production of some generics.

In all three scenarios, procurers would need to scramble for alternative suppliers in crisis-driven buys, with likely impacts to pricing.

How a Resolution Might Work

Clearly, business conditions must improve if generic medicines are to be reshored. These improvements must include:

- Addressing the domestic producers’ cost disadvantages vis-a-vis foreign competition.

- Assuring the producers of a reliable demand for their products, so that they are not confronted with idle capacity.

- Assuring the pharmaceutical procurers of a consistent, high-quality generics supply and stable pricing.

Applying Advanced Manufacturing Technologies

The API Innovation Center notes in Revitalizing US Pharma: Evaluating the Economic and Social Impacts of Advanced API Manufacturing in Missouri that advanced manufacturing technologies and techniques can often negate, in whole or in part, foreign competition’s cost advantages. Sardella says, “…a 30 percent cost reduction is targeted, and that actual reductions are sometimes as great as 50 percent…”

Technologies mentioned in this regard include continuous flow chemical manufacturing, additive manufacturing, and automation. However, concentrating solely on advanced technologies may only provide temporary relief to domestic producers.

u003cstrongu003eClick to open explainer: u003c/strongu003eu003cemu003eContinuous Flow Chemical Manufacturingu003c/emu003e

Continuous Flow Chemical Manufacturing

Continuous flow chemical manufacturing is a process where reactants are continuously fed into a reactor and products are continuously removed, without stopping the process. This is in contrast to batch processing, where reactants are added to a reactor at the beginning of the process and products are removed at the end.

Key advantages of continuous flow chemical manufacturing include:

Improved efficiency: Continuous flow processes can often be more efficient than batch processes, as they can operate at a higher throughput and with less downtime.

Better control: Continuous flow processes allow for more precise control of reaction conditions, which can lead to higher yields and improved product quality.

Reduced waste: Continuous flow processes can generate less waste than batch processes, as there is less need for cleaning and startup procedures.

Increased safety: Continuous flow processes can be safer than batch processes, as they can reduce the risk of runaway reactions and other hazards.

Common applications of continuous flow chemical manufacturing include:

Pharmaceutical production: Continuous flow processes can be used to manufacture a variety of pharmaceuticals, including active pharmaceutical ingredients (APIs) and drug intermediates.

Fine chemicals: Continuous flow processes can be used to produce fine chemicals, such as dyes, pigments, and flavors.

Specialty chemicals: Continuous flow processes can be used to produce specialty chemicals, such as catalysts, surfactants, and polymers.

Challenges of continuous flow chemical manufacturing:

Initial investment: The initial investment required to set up a continuous flow manufacturing facility can be higher than for a batch processing facility.

Scaling up: Scaling up a continuous flow process can be challenging, as it requires careful optimization of the reactor design and operating conditions.

Troubleshooting: Troubleshooting problems in a continuous flow process can be more difficult than in a batch process, as the process is constantly running.

Despite these challenges, continuous flow chemical manufacturing is a rapidly growing field with many potential benefits. As technology continues to advance, we can expect to see even more innovative applications of this process in the future.

For Additional Reading: A New Perspective on Continuous Flow Chemistry in the Pharmaceutical Industry

u003cstrongu003eClick to open explainer: u003c/strongu003eu003cemu003eAdditive and Atomically Precise Manufacturingu003c/emu003e

Additive and Atomically Precise Manufacturing

Additive Manufacturing

Building Layer by Layer: Additive Manufacturing, often referred to as 3D printing, is a process that creates three-dimensional objects by adding layers of material, typically layer by layer. This is in contrast to traditional manufacturing methods that involve removing material from a solid block.

How Does Additive Manufacturing Work?

Digital Design: A 3D model of the desired object is created using computer-aided design (CAD) software.

Slicing: The 3D model is sliced into hundreds or thousands of thin cross-sections, similar to the pages of a book.

Material Deposition: A machine, such as a 3D printer, deposits material layer by layer, following the instructions from the sliced model. This material can be plastic, metal, ceramic, or even biological materials.

Solidification: The deposited material is solidified, either through heat, light, or chemical reactions, to form the desired object.

Types of Additive Manufacturing

There are several methods of additive manufacturing, each with its own advantages and applications:

Fused Deposition Modeling (FDM): The most common type, FDM uses a heated nozzle to extrude molten plastic filament layer by layer.

Selective Laser Sintering (SLS): A laser beam selectively fuses powdered material, such as nylon or metal, to create the object.

Stereolithography (SLA): A laser beam cures liquid resin layer by layer to create the object.

Direct Metal Laser Sintering (DMLS): Similar to SLS, but uses metal powder and a high-power laser to create metal parts.

Benefits of Additive Manufacturing

Customization: Additive manufacturing allows for highly customized products, even in small quantities.

Complex Geometries: It can create intricate and complex shapes that would be difficult or impossible to produce using traditional methods.

Reduced Lead Times: Prototypes and small production runs can be produced quickly, reducing time-to-market.

Material Efficiency: Additive manufacturing can minimize waste by using only the material needed for the specific part.

References:

- 3D Printing Wikipedia: https://en.wikipedia.org/wiki/3D_printing

- Additive Manufacturing Institute: https://research.unm.edu/additivemanufacturing

- National Institute of Standards and Technology (NIST): https://www.nist.gov/additive-manufacturing

Additive manufacturing is a rapidly evolving field with numerous applications in industries such as aerospace, automotive, healthcare, and consumer goods. Its ability to create complex and customized parts is driving innovation and transforming the manufacturing landscape.

For Additional Reading, From MIT Sloan.

Additive Manufacturing, Explained

Atomically Precise Manufacturing

Atomically Precise Manufacturing (APM) is a theoretical manufacturing method that would allow the manipulation and placement of individual atoms to create structures with unprecedented precision and complexity. Essentially, it would be like building with LEGO bricks, but on a scale billions of times smaller.

Key Concepts and Potential Applications:

Bottom-up approach: APM would start with individual atoms and molecules, building up structures from the ground up.

Quantum-level control: It would require controlling the behavior of atoms at the quantum level, manipulating their properties and interactions.

Nanotechnology: APM is closely related to nanotechnology, as it would create structures on the nanoscale (billionths of a meter).

Potential applications:

Electronics: Creating incredibly small and powerful electronic components.

Materials: Designing materials with tailored properties, such as superconductors or ultra-strong materials.

Medicine: Developing targeted drug delivery systems and creating artificial organs.

Quantum computing: Building quantum computers with unprecedented computational power.

Challenges and Current State:

Technological hurdles: Controlling individual atoms is incredibly challenging, and current technologies are far from achieving the level of precision required for APM.

Theoretical understanding: A deep understanding of quantum mechanics and atomic interactions is essential for developing APM techniques.

Research and development: Significant research and development efforts are underway to explore the feasibility of APM and develop the necessary tools and techniques.

References:

- Nature Nanotechnology: https://www.nature.com/nnano/

- MIT Technology Review: https://www.technologyreview.com/

- American Chemical Society: https://pubs.acs.org/

An informative, albeit somewhat dated video demonstrating the potential application of APM in the production of electronic devices can be accessed here: Nanofactory Animation

While APM remains a theoretical concept, advancements in nanotechnology and quantum mechanics are gradually bringing it closer to reality. It’s a field with immense potential to revolutionize various industries and technologies.

u003cstrongu003eClick to open explainer: u003c/strongu003eu003cemu003eAutomation in Pharmaceuticalsu003c/emu003e

Automation in Pharmaceuticals

Automation in Pharmaceutical Production: Efficiency and Cost-Effectiveness

Automation has revolutionized the pharmaceutical industry, offering significant improvements in efficiency, quality, and cost-effectiveness. Here are some key areas where automation is making a substantial impact:

- Manufacturing Processes:

Robotic Manufacturing: Robots can handle tasks like tablet pressing, capsule filling, and vial sealing with precision and speed, reducing human error and increasing output.

Automated Packaging: Machines can package products, label them, and perform quality checks, minimizing manual labor and ensuring consistency.

Process Control: Automation systems can monitor and control manufacturing processes in real time, optimizing parameters like temperature, pressure, and mixing speed to ensure product quality.

- Quality Control:

Automated Testing: Machines can perform various quality tests, such as potency assays, purity analysis, and microbial testing, with greater accuracy and efficiency than manual methods.

Data Analysis: Automation systems can collect and analyze large amounts of data from manufacturing processes, identifying potential quality issues early on and enabling corrective actions.

- Supply Chain Management:

Inventory Management: Automated systems can track inventory levels and trigger replenishment orders when necessary, reducing the risk of stockouts or overstocking.

Traceability: Automation can ensure complete traceability of products throughout the supply chain, from raw materials to finished goods, facilitating recalls and regulatory compliance.

- Regulatory Compliance:

Data Management: Automated systems can help pharmaceutical companies comply with regulatory requirements by capturing, storing, and retrieving data accurately and efficiently.

Validation: Automation can simplify the validation of manufacturing processes and equipment, ensuring that they meet regulatory standards.

- Research and Development:

High-Throughput Screening: Automated systems can screen large numbers of compounds for potential therapeutic activity, accelerating drug discovery and development.

Data Analysis: Automation can help scientists analyze complex data sets generated from research experiments, identifying trends and patterns that may lead to new discoveries.

By leveraging automation, pharmaceutical companies can improve product quality, reduce costs, and meet increasing regulatory demands. This technology is essential for ensuring the safe and effective production of medicines that meet the needs of patients worldwide.

As noted in How to Succeed as a Chief Digital Officer in Pharma (Hung, Amy, Oliver Lecler, and Travis Murdoch, March 2017, McKinsey & Company), technology alone is unlikely to be a sustainable differentiator, as gains from early adoption diminish as the technology becomes more affordable and accessible globally. A more sustainable approach involves:

- Building on regional strengths and core competencies.

- A focus on building teams, culture, and processes, not just tools.

- Continuous product and process technology innovation and improvement.

API Innovation Center Plans

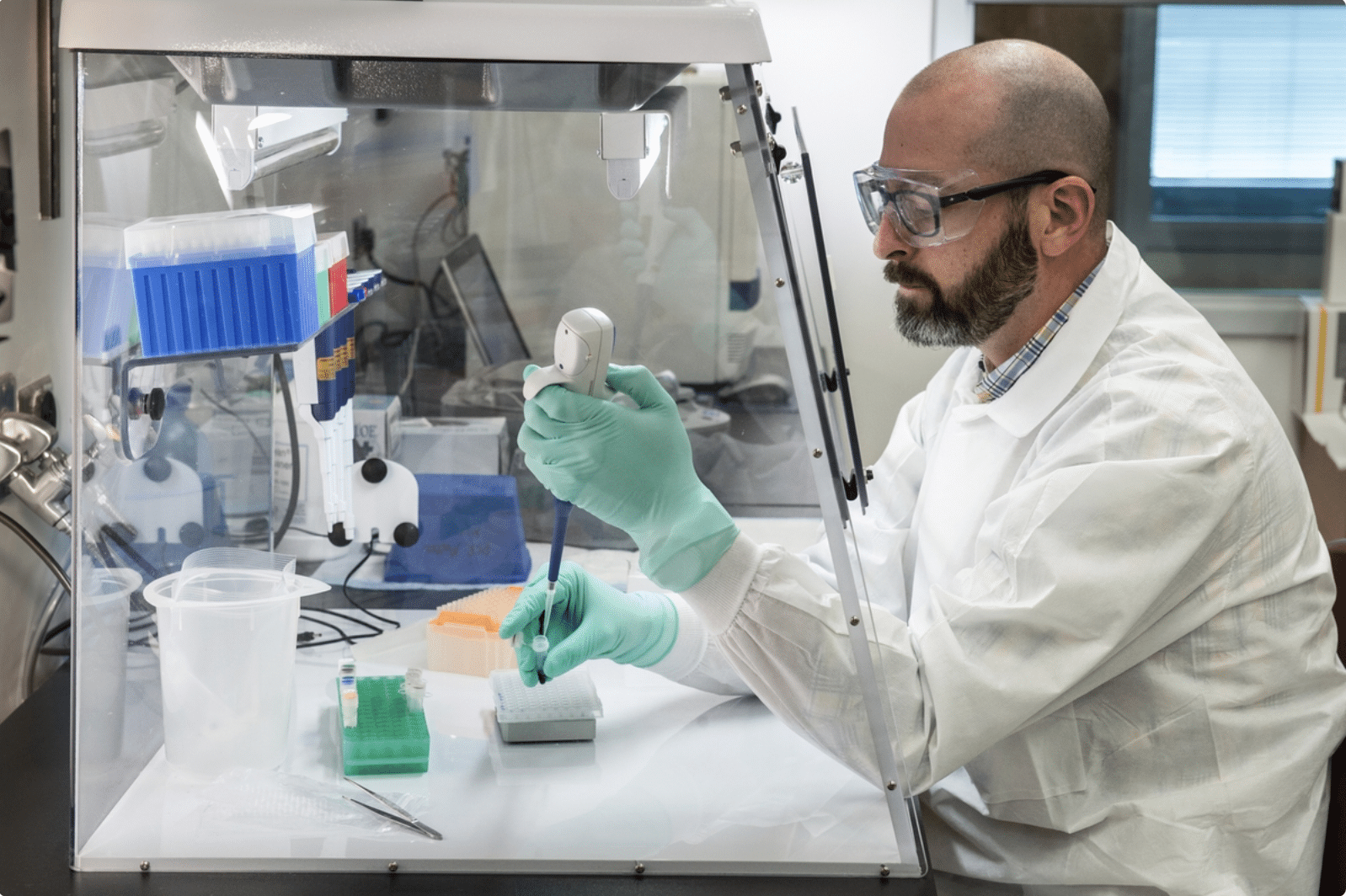

It is this more sustainable approach that is being planned by the API Innovation Center. Sardella says that, “… advanced technology and tools alone do not make for a sustainable competitive advantage. Our emphasis is on processes and culture …”

As the API Innovation Center is located in the Cortex Innovation District, it will thus benefit from the teaming and “happy collisions of people” for which innovation districts are built. The API Innovation Center will leverage the region’s bioscience and manufacturing strengths, which will push the state-of-the-art ever forward. For example, additive manufacturing is presently being applied to smaller-scale objects.

Eventually, it may be possible to manipulate things at the molecular level, which would open the door to completely different ways manufacturing pharmaceuticals. Such advanced processes would further reduce labor content and costs, reduce waste, and make quality even more consistent.

To make use of such a forward-leaning technology, though, innovation will be required in the molecular biology by which drugs are designed.

Sharing Prosperity While Sustaining Innovation

This brings us to an important point that needs to be stressed. Reshoring the manufacturing of generics and APIs will engage a wide swath of the labor force.

Tony, himself also a distinguished professor at Washington University’s Olin Business School, says that, “… the manufacturing and business processes will be systematized and executed largely by trained workers. Often, a two-year college degree or technical and on-the-job training, or both, may be all the formal background needed. This is not something just for Ph.D.’s and post-docs.”

A potential risk to this process systematization, however, is that innovation may be driven out. If execution becomes much more important than developing new technologies and products, there could be a gradual erosion of the area’s ability to reinvent itself.

Take Detroit, as an example of how process systematization drives innovation out of the region

In the view of many writers, this is what may have happened to Detroit and the greater industrial midwest in the mid-twentieth century. Routinized automobile production came to so dominate regional economies that other, smaller industries in which innovation rather than execution was important were selected out.

Then, when the market for automobiles changed due to imports and more automated production processes, local economies suffered. Efficiency [of production] came to drive away innovation and, with it, resilience to change.

Fortuitously, the path charted out by the API Innovation Center, as noted, engages both the innovation and execution sides of the regional economy.

Furthermore, leveraged regional strengths will function as a barrier to entry. While API and generic medicine production will by no means be limited to Missouri, the innovation cluster being created is unlikely to be commoditized.

Technology Transfer and Partners

It is imperative that the new technologies and processes be adopted by commercial producers. Unfortunately, as Tony Sardella notes, “… pharmaceutical manufacturers surveyed by the API Innovation Center are unlikely to invest in advanced manufacturing and processes, however promising to long-term competitive strength. Technology transfer is essential to making all this work.”

Returns on generics and APIs are just too meager to justify such an investment. In addition, technology development often involves considerable trial and error, with what looked like promising approaches often not working out and needing to be changed prior to implementation. This all costs time and money.

This is where regional strengths and intellectual capital come in. Academia, think-tanks, and other institutions will research the advanced manufacturing and process improvements needed to make onshore manufacture of these medicines viable, then transfer this knowledge to commercial industry.

The community engaged in this R&D, in addition to the API Innovation Center, the Cortex community, and Washington University in St. Louis, includes:

- The University of Missouri at St. Louis

- Missouri Enterprise (for manufacturing expertise)

- the Missouri Biotechnology Association (MOBIO)

- the Glioblastoma Foundation

Funding and Public Sector Support

The Missouri Technology Corporation (MTC) has been very forward-looking in providing much early funding. Other public sector players in the API Innovation Center’s ecosystem include:

- The Gateway Manufacturing Coalition

- The United States Department of Commerce Economic Development Administration

- The United States Small Business Administration

- The United States Department of Health and Human Services

Use of Existing, Underutilized Production Facilities

One potential bottleneck in this reshoring effort is the construction of new production facilities, which typically takes five to ten years and up to a $2 billion investment per plant. However, if existing, underutilized plant and equipment could be repurposed, this roadblock would be circumvented.

This repurposing is the path recommended in the API Innovation Center studies. A survey indicates that about 30 percent of domestic pharmaceutical manufacturing sites are operating at less than 50 percent capacity.

Further, assuming the foregoing changes in business conditions, 56.7 percent of idled US production could be at full capacity within one year, 86.4 percent within two years, and 100.0 percent within three years.

Reliable, Long-Term Markets and Suppliers – The Holistic Approach

Yet another advantage of rebuilding the domestic generic manufacturing base would be to provide stable demand for the producers and a reliable supply with consistent pricing for procurers. Also, all US production facilities would be required to obtain an FDA Good Manufacturing Practices (GMP) certification, helping to ensure the quality of the methods, equipment, facilities, and controls used to produce and test products.

Sardella summarized this holistic approach to reshoring generic pharmaceutical manufacturing as, “The API Innovation Center will encourage producers and procurers to work together with a long-term, end-contract in mind. Both sides will cooperate to achieve certainty of demand and pricing.”

Regional Economy Benefits

The benefits of rebuilding the API and generic manufacturing base to the regional economy would be significant, and would include economic, workforce, and regional perception impacts.

Economic Impacts

The API Innovation Center estimates that the benefits to the regional economy of reshoring each generic drug or API include:

- $22.2 to $23.2 million in direct impacts, or the salaries, wages, etc. resulting from new jobs.

- $2.6 to $2.7 million in indirect benefits, or the additional business to vendors, suppliers, etc.

- $24.1 to $25.2 million in induced benefits, which result from the increased spending in the regional economy stemming from increased wages at the producers and their vendors and suppliers.

The total benefits per drug or API reshored thus equate to $49 to $51 million.

For the six drugs to be reshored as part of an initial effort, total economic benefits would be up to $306 million. Longer term (about a decade), the API Innovation Center anticipates reshoring up to 300 to 350 APIs and generic medicines, which would net out to a $17.85 billion impact.

Workforce Impacts

Moreover, enhancements will accrue to the regional workforce. As noted, a wide swath of workers will find employment in a high-tech, manufacturing environment (which pays about 10 percent more than Missouri’s private sector average), gaining valuable career skills. They will participate in specialized training (both on-the-job and at local vocational and technical training institutions) and earn certifications. All this usually leads to upward mobility and a middle-class lifestyle.

In addition, the high-tech environment in which they will be working will leverage younger workers’ comfort and familiarity with technology. Sardella says that, “… the pharma production processes tie into younger workers being digital natives…”

Regional Perception

The generics reshoring would also enhance Missouri’s global reputation as a bioscience and pharmaceutical manufacturing hub. This is where agglomerative economics come to play.

- The presence of lots of pharmaceutical producers will attract people with pharmaceutical manufacturing or related expertise, who wish to take advantage of the regional job market.

- The presence of these people, in turn, will attract yet more pharmaceutical makers the area, since they will benefit from access to a well-trained and high-quality workforce.

- In turn, these additional producers will attract more people to the great job market … And a virtuous cycle ensues.

Conclusion

EQ has talked about the reinvention of St. Louis around entrepreneurs, technology, innovation, and learning clusters.

The reshoring of generics and rebuilding of this vital industrial base via the path charted out by the API Innovation Center is a critical part of this reinvention. What’s more, reshoring benefits would be readily shared with workers who may not always participate in high-end, R&D-intensive startups.

Finally, rebuilding domestic API and generic drug manufacturing will provide health security benefits for people far removed from the St. Louis MSA and Missouri.

Having access to high-quality, affordable and readily available generic medicines is vital to keeping Americans healthy. It also makes our country more resilient to health crises and less vulnerable to geopolitical arm twisting.